Estate Plan (Single)

SKU:

$675.00

$675.00

Unavailable

per item

Description

Purpose:

This package enables a California resident to create a basic estate plan. It does not include any tax planning, special needs planning, trust funding services, or title work. It also does not create sub-trusts, allow for deferred distribution post-death, non-U.S. asset planning, and other complex trust structuring or estate planning matters.

A basic estate plan allows you to (i) designate post-death beneficiaries of your estate (i.e., assets), (ii) nominate agents to manage your estate and make your financial and medical decisions, and (ii) nominate guardians for your minor child(ren), if applicable.

This package enables a California resident to create a basic estate plan. It does not include any tax planning, special needs planning, trust funding services, or title work. It also does not create sub-trusts, allow for deferred distribution post-death, non-U.S. asset planning, and other complex trust structuring or estate planning matters.

A basic estate plan allows you to (i) designate post-death beneficiaries of your estate (i.e., assets), (ii) nominate agents to manage your estate and make your financial and medical decisions, and (ii) nominate guardians for your minor child(ren), if applicable.

Documents Included:

Add-ons:

Instructions:

- Certification of Trust (required for trust funding)

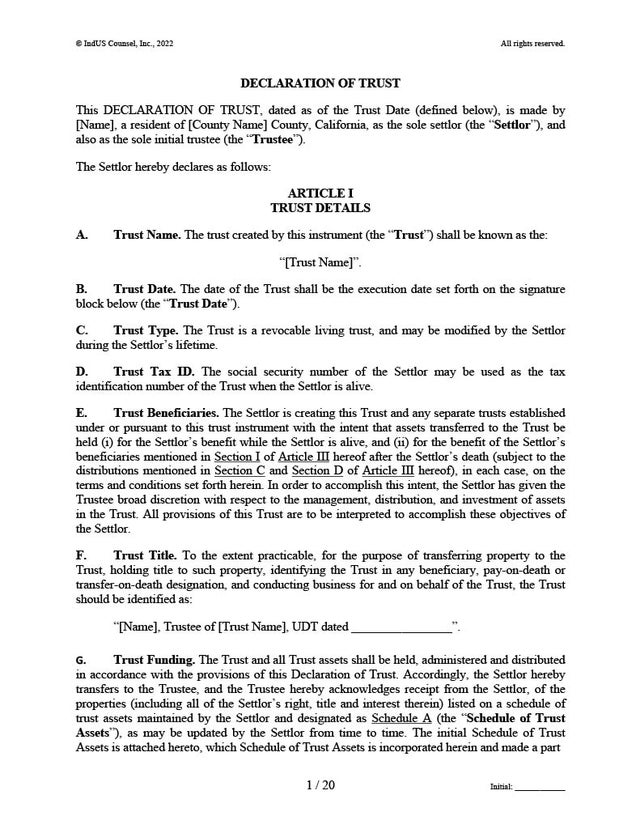

- Declaration of Trust (legal agreement that creates your revocable living trust)

- Pour Over Will (your Last Will and Testatment)

- Financial Power of Attorney (allows others to access your financial records and make your financial decisions during your incapacity)

- Health Care Directives (allows others to make your medical decisions during your incapacity and after your death)

- HIPAA Authorization (allows others to access your medical records during your incapacity and after your death)

- Assignment of Property (puts your personal property in your trust)

- Personal Property Memorandum (to be used in future if you wish to gift any item of personal property to someone other than your trust beneficiaries)

- Guardianship Declaration (if applicable, for taking care of your minor child(ren))

- Funding Checklist (explains how to transfer your assets to your trust)

- Signing Instructions (explains how to notarize and/or witness your estate planning documents)

- Post-Signing To-Do List (lists important post-signing tasks)

Add-ons:

- Notary and witness services. These will be provided exclusively at our Fremont office during our normal business hours by prior appointment only for an additional fee of $75.

- Title transfer services. We offer California title recording services related to transferring your property to your trust. These will be provided exclusively at our Fremont office during our normal business hours by prior appointment only for an additional fee of $250 per deed (excluding county recording fees and any third party charges).

Instructions:

- Add this item to your cart. To view the product description, please click the "+" sign next to the "Description" on just above the "ADD TO CART" button above.

- After you add the item to your cart, click here to access our Estate Plan (Single) questionnaire. You will be redirected to our secure portal to fill out the questionnaire.

- Create an account on the portal to access your questionnaire, or login if you have an account. Note that the portal is managed by our third party vendor, Documate.

- If the questionnaire does not show up on your dashboard after you create an account, please click the above link again and it will show up the second time!

- Complete the questionnaire and submit it on the portal.

- Come back to this website to check out from your cart and remit payment (see the Cart Icon on the top right corner).

- We will e-deliver your documents after we receive your completed questionnaire and payment.